Medical staff at a rapid COVID-19 test center in Jakarta, Indonesia, June 8, 2020. (Veri Sanovri)

2020 was half gone before anyone noticed. The sudden outbreak of COVID-19 spurred dramatic changes in recent months as it decimated various economic sectors worldwide, especially services including restaurants and tourism. The economic havoc wreaked by the pandemic continues to pile up, and the global economy is expected to shrink by 5.2 percent this year, creating “the worst recession since World War II,” according to World Bank forecasts.

As epidemic containment improved, many countries gradually eased lockdown restrictions, yet boosting the economy amid the pandemic still seems like a daunting task. Data show that in the first half of this year, China’s exports of epidemic prevention supplies and “stay-at-home economy” products grew rapidly, whereas the exports of mechanical and electrical products and labor-intensive products both dropped worse than the overall decline. Globally, COVID-19 challenges and circumstances have varied from country to country and economic blockades have been introduced at different times as have subsequent resumption of work and production varied widely in each nation.

In the second half of 2020, the road to world economic recovery will remain bumpy and full of uncertainty. The pandemic disrupted the global supply chain, forced multinational companies to close factories, and dealt a blow to global trade, leading to a spike in anti-globalization sentiment and policies. However, economic globalization remains the central development trend, and it would be prohibitively inefficient, costly, and unrealistic for Western countries to move industrial chains back home, especially considering current epidemic risks. Profits steer a market economy, and the appeal of more extensive and freer flows of goods, services, personnel, capital, and information will persist. We must embrace globalization and multilateral cooperation, which are vital tools in the global fight against the coronavirus and will also contribute to early recovery of the global economy in the post-pandemic era.

TWO GOALS, ONE SUMMIT

ASEAN leaders reach consensus on economic recovery in the post-pandemic era

Under the theme “Cohesive and Responsive ASEAN,” the 36th ASEAN Summit was held via video conferencing on June 26, presided over by Vietnam, which currently holds the rotating chair of ASEAN. The meeting was attended by leaders of the 10 ASEAN member states and the Secretary General of ASEAN. The leaders of ASEAN countries reached consensus on economic recovery in the post-pandemic era, pledging to work together to reduce the impact of the COVID-19 pandemic on the regional economy, maintain stability of the industrial chain and supply chain, and strengthen cooperation with China and other partner countries.

Although the ASEAN leaders were unable to meet in person in Vietnam as planned to perform the usual ASEAN-style handshake, the virtual summit facilitated broad consensus on important issues.

Achieving Dual Goals

Vietnamese Prime Minister Nguyen Xuan Phuc spoke highly of the anti-epidemic achievements of ASEAN countries and opined that ASEAN countries should work together on social development and post-pandemic economic recovery while strengthening cooperation with partner countries to overcome the pandemic. Consensus reached at the Special ASEAN Plus Three Summit on COVID-19 in April was reaffirmed. Participating ASEAN leaders unanimously agreed to continue to strengthen cooperation with dialogue partners in the fight against the epidemic and strive to achieve the dual goals of fighting the pandemic and restoring the economy.

At the summit, ASEAN announced the establishment of the COVID-19 ASEAN Response Fund alongside commitment to promote ASEAN’s recovery and develop a comprehensive recovery framework to help restart and recover the regional economy. Philippine President Rodrigo Duterte called for a joint fight against the coronavirus pandemic and urged ASEAN member states to share anti-virus technology, cooperate in production, rationally distribute vaccine resources, and strive for effective supply of high-quality vaccines based on the ASEAN Leaders’ Declaration on ASEAN Vaccine Security and Self-Reliance.

The ASEAN Leaders’ Vision Statement on a Cohesive and Responsive ASEAN was adopted at the summit. ASEAN leaders emphasized strengthening solidarity, cooperation, economic integration, and awareness, and enhancing ASEAN’s ability to adapt actively. They reaffirmed maintenance of an open, transparent, and law-based regional structure, in which ASEAN plays a central role and continues to promote ASEAN connectivity. The leaders pledged to implement ASEAN Community Vision 2025 to build an ASEAN Community that is united, people-centered, based on law, and connected to foreign partners.

Laos Deputy Foreign Minister Thongphan Savanphet said that the biggest advances in the realization of the Master Plan on ASEAN Connectivity 2025 will be reflected in the three pillars of ASEAN, namely the Political-Security Community, the Economic Community and the Socio-Cultural Community. ASEAN leaders emphasized that disputes should be settled through peaceful means under international law and that the use or threat of force should be avoided.

The pandemic has caused a tremendous impact on the economy and society of ASEAN countries. ASEAN is an export-oriented economy. Due to the pandemic, some countries are faced with difficulties such as insufficient supply of raw materials. Maintaining the stability of the regional industrial and supply chain was a hot topic at the summit. Secretary General of ASEAN Dato Lim Jock Hoi lamented that the ASEAN economy is entering another recession since the Asian financial crisis. Leaders of Thailand, Brunei, Malaysia, and Indonesia proposed relaxing travel restrictions among ASEAN member states to revitalize regional tourism and promote economic recovery. Singaporean Prime Minister Lee Hsien Loong noted that all countries globally are now investing huge sums of money in protecting employment and the economy but stressed that none of them can keep trade flowing or the international supply chains running independently. He suggested countries in the region therefore must work together to maintain the rules-based international trading system and supply chain stability.

In the process of economic recovery, the digital economy is playing a big role. Myanmar State Counsellor Aung San Suu Kyi commented on how the COVID-19 pandemic has also accelerated the development of digital technologies and the digital economy, suggesting ASEAN seize the opportunities presented by the Fourth Industrial Revolution (Industry 4.0) to achieve greater development in the region. Thailand’s Prime Minister Prayut Chan-o-cha said, “The digital economy is the key to increasing the scientific and technological makeup of ASEAN member states’ GDP, so more should be invested in ASEAN’s digital infrastructure.” The Chairman’s Statement of the Summit stressed that ASEAN countries have recognized the indispensable role of digital technologies in economic recovery and resolved to redouble efforts to prepare for the “Industry 4.0” to build a robust, integrated, and inclusive digital economy.

Firm Determination

ASEAN countries reiterated commitment to accelerating the process of regional economic integration and trade liberalization. On the sidelines of the 36th ASEAN Summit, a Regional Comprehensive Economic Partnership (RCEP) ministerial meeting was held via video conference. The participants agreed to strive to sign the RCEP agreement by the end of this year, which “demonstrates the firm commitment of ASEAN and its partners to upholding an open, inclusive and rules-based multi-lateral trading system,” as the Chairman’s Statement noted.

RCEP negotiations were started by 10 ASEAN countries in 2012. Other participating countries include China, Australia, South Korea, Japan, India and New Zealand. The 16 RCEP countries account for 47 percent of the global population. The 3rd RCEP Summit, held on November 4, 2019, announced that 15 member countries excluding India had concluded all text negotiations and all substantive market access negotiations and would work together to ensure signing of the agreement in 2020.

According to Minister of Industry and Trade of Vietnam Tran Tuan Anh, ASEAN is currently working with dialogue partners to expedite review of the complete legal text for participants to sign at the East Asia Summit in November this year.

Singapore Minister of Trade and Industry Chan Chun Sing said that although the RCEP countries are at different stages of development, they can draw on each other’s strengths and intensify economic cooperation. Santisouk Phounesavath, member of the Lao RCEP negotiating delegation, stressed that getting the agreement done by the end of this year is direly needed to aid economic recovery from the COVID-19 pandemic.

Vietnam Television reported that ASEAN and dialogue partners have become very determined to sign the RCEP. Once implemented, the agreement will inject new vitality into regional and global trade.

China’s Contribution

In recent years, pragmatic cooperation between China and ASEAN has been expanding. Both sides have supported each other and cooperated in not only fighting the COVID-19 pandemic but also in advancing the RCEP negotiations. At the summit, ASEAN leaders emphasized that against the backdrop of the global economic downturn, they should strengthen cooperation with dialogue partners such as China as part of efforts to maintain ASEAN economic growth and promote regional economic recovery.

During the COVID-19 pandemic, China has joined hands with the countries in the region to coordinate China’s domestic sourcing of goods and strived to maintain the stability of industrial and supply chains in the region. For example, China coordinated multiple shipping companies to arrange shipment of raw materials for textiles to Cambodia.

“Stabilizing the supply chain means stabilizing the production of enterprises and preserving the jobs of industrial workers,” said Tang Zhimin, director of China ASEAN Studies Center, Panyapiwat Institute of Management, in an interview with People’s Daily. “The world’s second largest economy recovered rapidly, which is a big deal for maintaining the stability of industrial and supply chains in the region and the world.”

China and ASEAN have continued to strengthen cooperation in the digital economy. The opening ceremony of China-ASEAN Year of Digital Economy Cooperation was held on June 12. The campaign aims strengthen cooperation in the digital world, facilitate sharing of experience in digital epidemic prevention and control, expand digital infrastructure construction, accelerate digital transformation, improve communication mechanisms, and distribute the dividends of digital economic development. Dato Lim Jock Hoi opined that China has a high level of expertise in developing digital infrastructure and implementing digital economic regulatory framework and has been an important partner of ASEAN in promoting digital economic development in the region.

Joint construction of the “Belt and Road” has provided fuel for ASEAN’s economic and social development. Many large-scale projects contracted by Chinese enterprises have worked hard to overcome the pandemic while pressing forward to ensure infrastructure construction advances. On June 21, the second longest tunnel of the China-Laos railway was completed. Accelerated advancement of China-Laos railway construction is key for Laos to transform from a landlocked to a land-linked country and promote regional connectivity. Vinh Tan Power Company, established by Chinese companies in Binh Thuan Province of Vietnam, generated 898 million kilowatt hours in May, an increase of 23.35 percent year-on-year, which has contributed to local economic development and improved the living standards of area residents.

“All countries in East Asia are now facing the urgent task of restoring the economy. Increasing cooperation between ASEAN and China to build the Belt and Road will tremendously soften the impact of the pandemic on the regional economy and stimulate regional economic growth while at the same time injecting confidence and momentum into the world economy,” Tang Zhimin said.

Children attending the live performance at the 36th ASEAN Summit opening ceremony watch the video conference through a screen in Hanoi on June 26, 2020. The summit was held via video conferencing, focusing on COVID-19 response and post-pandemic recovery. (WANG DI)

Staff greet customers at the entrance of a shopping mall in Bangkok on May 17, 2020. (RACHEN SAGEAMSAK)

COVID-19’S MARK ON THE ASEAN ECONOMY

Achieving medium-term economic goals may be a daunting challenge for ASEAN countries

By Wang Qin

As the COVID-19 pandemic spread at alarming speed, the economic activities in ASEAN member states were disrupted when governments implemented tough containment measures. Since the situation was gradually brought under control in May, these countries have launched work on rebooting the economy and digging a way out of the epidemic.

Considering the grim picture, most governments of ASEAN countries revised their economic projections for 2020. Indonesia trimmed its gross domestic product (GDP) annual growth forecast from an estimated 5.3 percent to 0.4 to 2.3 percent, a speed not seen since 1999. Laos revised its 2020 growth rate from 6.5 percent to 3.3 to 3.6 percent. With projected growth falling to -2 to -0.5 percent from 4.8 percent, Malaysia predicted a contraction for the first time in a decade. The Philippines lowered its GDP growth forecast from 6.5 to 7.5 percent to -0.8 to zero percent, its first contraction in more than 20 years. After repeatedly adjusting growth projections from 2.5 percent to -1 percent and then to -7 percent, Singapore warned residents to brace for the country’s worst economic downturn since its founding. According to the Bank of Thailand, the country’s economy will shrink by 5 to 6 percent this year, down from the previously estimated 2.8 percent growth. Vietnam still believes a 5 percent growth rate is achievable but not its original target of 6.8 percent.

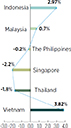

According to recent official statistics, in the first quarter of 2020, Vietnam registered a growth rate of 3.82 percent, Indonesia 2.97 percent, Malaysia 0.7 percent, the Philippines -0.2 percent, Thailand -1.8 percent, and Singapore -2.2 percent.

The COVID-19 outbreak left a severe immediate impact on ASEAN economies, and has far-reaching implications for these countries in the medium term. The world is nowhere near the end of the public health crisis, so the severity of the economic contraction remains uncertain. But it will certainly be more challenging for governments of ASEAN nations to achieve their medium and long-term economic development goals. In the medium term, the process of economic transformation and industrial upgrading in these countries will slow, and the flow of goods, capital and labor in the region will be impeded by the pandemic, restricting participation in value chains at both global and regional levels.

ASEAN member states faces a daunting challenge in achieving their medium-term economic development objectives. After the thriving early decades of the 21st Century, governments in the region designed medium and long-term development plans accordingly. Indonesia aimed to become one of the world’s top ten economies by 2030, with annual GDP growth averaging 6 to 7 percent between 2018 and 2030. After rising from a low-income nation to rank with lower middle-income countries by 2016, Cambodia aspired to become an upper middle-income country by 2030. As early as 2010, Malaysia eyed joining high-income countries by 2020 by reaching per capita gross national income (GNI) of US$15,000. The Philippines set ambitious goals including an average annual GDP growth rate of 7 to 8 percent from 2018 to 2022, becoming an upper middle-income country by 2020, and a per capita GNI of US$5,000 by 2022. Thailand was attempting to increase its per capita GDP to US$10,100 by 2030 from US$8,800 in 2019. Vietnam outlined a three-step plan to become an upper middle-income country with per capita GDP of US$4,500 by 2025 and US$10,000 by 2035 before joining the high-income club by 2045. The raging pandemic, however, disrupted normal economic activities in the ASEAN region and hindered the process of economic restructuring, creating monumental challenges for countries in the region to realize their respective national development goals on schedule.

Over the past two decades, Indonesia has experienced rapid growth that peaked at over 6 percent between 2010 and 2012. With momentum slowing in recent years, the COVID-19 epidemic has made it even more difficult for the largest economy in ASEAN to achieve its economic targets for the next decade. The current per capita GNI of Malaysia exceeds US$10,000, but it still has a way to go to meet the criteria of high-income countries. According to World Bank estimates, the pandemic will slow Malaysia’s climb to a high-income country, which was previously predicted to last until 2024. The Philippines enjoyed an economic jolt in 2012 and has since maintained a growth rate above 6 percent for seven consecutive years. Now due to COVID-19 outbreak, the country will see its first negative economic growth in more than 20 years and major thorns along its road to becoming an upper middle-income country. The Thai public believes that it will take at least three years for the national economy to fully recover from the setback. The Thai government has been pressured to make appropriate adjustments to its national development strategy. Suffering the least among ASEAN member states, Vietnam will still lose much of its previous strong growth momentum, and the country’s prospects to become an upper middle-income country by 2025 no longer look as promising.

Economic transformation and industrial upgrading in ASEAN nations will slow. To maximize opportunities from the Fourth Industrial Revolution (Industry 4.0) and promote the transformation of traditional industries and development of emerging industries, countries in the region have successively introduced strategies and policies related to “Industry 4.0” in recent years. Released at the 35th ASEAN Summit in November 2019, the ASEAN Declaration on Industrial Transformation to Industry 4.0 reaffirmed its member states’ commitments to advance Industry 4.0 through an ASEAN consolidated strategy. After the COVID-19 outbreak, however, many projects supported by Industry 4.0 strategies stalled and fixed-assets investment in most members of the organization slipped substantially or grew only slightly. In the first quarter of 2020, investment of Indonesia and Vietnam in fixed assets increased by 1.47 and 2.2 percent, respectively. Investment in the Eastern Economic Corridor, Thailand’s flagship Industry 4.0 project, fell by nearly 50 percent. A key infrastructure project for Indonesia, the Jakarta-Bandung high-speed railway continued construction amid the epidemic but struggled to make progress due to a shortage of technical staff and raw materials. Construction of Malaysia’s East Coast Rail Link (ECRL) project resumed in July 2019 but quickly came to a standstill because of movement control measures. Currently only part of the project is seeing any action.

Free flow of goods, capital, and labor in the ASEAN region will slow. Creating a single market characterized by free flow of goods, capital, and labor was a primary goal on ASEAN’s regional economic integration agenda. To this end, governments of ASEAN countries have implemented a package of measures such as trade facilitation, reducing tariff and non-tariff barriers, establishing a free and open investment regime, and enhancing the mobility of professionals and skilled workers within the region. As of May 2019, 98.6 percent of ASEAN goods enjoyed zero tariff treatment. Because of the COVID-19 pandemic, ASEAN factor markets have slumped, and intraregional trade and investment has dropped sharply. Although ASEAN’s measures to facilitate mobility eye skilled labor, movement of migrant workers in the region has grown strongly. According to the World Bank report Migrating to Opportunity, ASEAN now has over 7 million migrants from within the region, and intraregional migration is highly concentrated in three major groups of corridors: the Thailand corridor for migration from Cambodia, Laos and Myanmar, the Malaysia corridor for migration from Thailand, Indonesia, Myanmar and Vietnam, and the Singapore corridor for migration from Indonesia. The epidemic outbreak has hindered labor mobility within ASEAN and posed challenges for authorities in host countries to enact containment measures among the migrant population. About 1.2 million Indonesian migrants work in Malaysia. With their labor contracts now invalid, more than 88,700 workers have returned to their home country unemployed. In Singapore, about 94 percent of confirmed COVID-19 cases have been foreign workers, and the country hosts a million-strong foreign labor force.

ASEAN countries’ participation in global value chains (GVCs) and regional production networks will be restricted. An outcome of the evolving international industrial division of labor, GVCs are networks of production around the globe largely led by multinational enterprises (MNEs). Through vertical integration, production outsourcing, and global procurement, MNEs coordinate different phases of the production process that take place in different countries. ASEAN has become an increasingly important link for GVCs. With GVCs and regional industrial chains disrupted by the COVID-19 pandemic, export-oriented businesses in ASEAN countries were badly hit. In Vietnam, assembly plants shut down because import of intermediate goods, primarily semi-finished products and parts, was blocked. The ongoing global public health crisis is highlighting the fragility of the GVCs, and momentum for value chain restructuring led by MNEs will grow in the post-epidemic era. Companies will focus more on security, localization, the institutional environment of host countries, and even political factors influencing relations between major powers. GVC restructuring had already started before the epidemic outbreak, and China-U.S. trade friction has accelerated the process. China is both a major manufacturing powerhouse and the world’s largest consumer market. Although some multinationals are gradually shifting phases of production from China to ASEAN countries, they must still maintain their production and operation bases in China because a considerable portion of intermediate products are produced by MNE-invested enterprises in China or by local companies. So, GVC restructuring is unlikely to finish shortly after the COVID-19 pandemic ends, which may slow the withdrawal of MNE value chains from China.

A man rides by a barbed wire fence blocking access to a controlled area in Kuala Lumpur, Malaysia, on May 15, 2020. (Chong Voon Chung)

Customers maintain social distance in a post office in Yogyakarta, Indonesia, on April 9, 2020. (SUPRIYANTO)

A street in Kuala Lumpur, Malaysia, May 16, 2020. (Chong Voon Chung)

According to recent official statistics, in the first quarter of 2020, Vietnam registered a growth rate of 3.82 percent, Indonesia 2.97 percent, Malaysia 0.7 percent, the Philippines -0.2 percent, Thailand -1.8 percent, and Singapore -2.2 percent.

About the author Wang Qin holds a PhD in Economics and serves as a professor at the Center for Southeast Asian Studies at Xiamen University.

EMBRACING THE DIGITAL

China and ASEAN explore prospects for digital economy cooperation

By Yuan Yanan

The spread of novel coronavirus pandemic hit the global economy hard, and economic growth in China and ASEAN countries has slowed significantly. However, the epidemic has brought the digital economy new development opportunities. The stay-at-home lifestyle has fostered the rise of the internet economy, and digital technology has become a key driving force for economic development.

New Opportunities

Miao Wei, minister of Industry and Information Technology of China, said at the opening ceremony of the China-ASEAN Year of Digital Economy Cooperation on June 12 that digital applications guaranteed people’s needs during the epidemic. In China, online teaching, digital classes, and other forms of distance education have ensured that more than 200 million students across the country continue studying despite cancellation of in-person classes. Online medical platforms such as WeDoctor facilitate remote consultation and drug delivery services, reducing risk of virus transmission. Remote office software such as WeLink (an intelligent work platform by Huawei), WeChat Work (a business communication and office collaboration tool by Tencent Technology), Tencent Meeting and DingTalk (an app by Alibaba) served the needs of more than 300 million users nationwide.

In Southeast Asia, the stay-at-home lifestyle has also promoted new development of the digital economy. Lazada, a Singapore-based e-commerce platform owned by Alibaba Group, has seen a fourfold increase in the grocery sales in Singapore from early April to early June. Shopee is a leading e-commerce platform in Southeast Asia. In the first quarter of this year, its order amount reached about US$430 million, an increase of 111.2 percent over the same period last year. Consumers generally started choosing electronic payment methods instead of cash.

Shopee Chief Commercial Officer Zhou Junjie said that the COVID-19 pandemic has accelerated the transition to online lifestyles, which is irreversible.

GoFood, a delivery service of Gojek, a leading on-demand and multi-service tech platform in Southeast Asia, increased its trade volume by 10 percent in less than a month. Just three months ago when offline consumption was generally depressed, Gojek received US$1.2 billion in financing. Gojek stated that the company would focus more on the development of digital economy to support payment and financial services in Southeast Asia.

With schools and educational institutions temporarily closed due to COVID-19, online education has been filling the gap. In Indonesia, Malaysia, Thailand and Vietnam, many educational technology companies have witnessed a rapid growth. Snapask, a Hong Kong-based online learning website targeting the Southeast Asian market, gained nearly 400,000 new users between February and March this year, 30 percent of all new users it gained in 2019. Usage and questions raised on the website also increased by 40 percent between February and March this year. Snapask founder Timothy Yu believes that online education is becoming normalized. “The choice between ‘online tutoring’ and ‘offline learning’ is becoming a thing of the past,” he said.

In China, the rapid development of e-commerce and online education has been accompanied by more “cloud mode” activities such as telecommuting, online consultation and online governance. China has accumulated rich experience in these realms.

“During the epidemic, new digital technologies that minimize or eliminate contact were rapidly introduced in China, providing us with much valuable experience to draw from,” said Miao Wei. “We are ready to share our experience with ASEAN countries, tap the potential of the digital economy, and jointly make positive contributions to protecting life, restoring economic stability, and promoting sustainable growth.”

Joint Development

The digital economy includes a vast array of activities and needs long-term planning and comprehensive organization. S Iswaran, minister for Trade and Industry of Singapore, opined that Singapore has unique advantages as a digital industry hub of the ASEAN region, making the country a good platform for Chinese internet companies to seek new market opportunities in ASEAN countries.

China and ASEAN have conducted successful explorations before. In terms of information infrastructure, the successful launch of the “Laos No.1” communications satellite brought China and ASEAN closer. A new undersea cable project jointly constructed by China and Thailand is planned to go live in early 2021. After completion, the cable will ensure delivery of various data between China and Thailand to facilitate business cooperation, tourism, finance, and internet development.

Cambodia, Thailand, Indonesia, and the Philippines are cooperating with Chinese companies to jointly build local 5G networks. Huawei completed 5G tests in the Philippines in January, which set a new 5G speed record. With the completion of 5G networks, smart cities, smart grids, real-time logistics tracking, autonomous driving, and real-time industrial control may all become reality.

In the field of digital research and development, National University of Singapore (NUS) and Suzhou Industrial Park jointly established the NUS Artificial Intelligence Innovation and Commercialization Center to facilitate the formation of an artificial intelligence (AI) ecosystem and industrial chain in Suzhou, eastern China’s Jiangsu Province. A Malaysian company and a Chinese company are jointly building Malaysia’s first AI industrial park, which will provide AI solutions in intelligent vision, voice recognition, natural language, and robotics. Thailand has contracted Chinese company Xunlei Limited to use cloud computing and blockchain technologies to promote Thailand’s digital identity system and smart city construction.

Singapore enterprises have turned to Alipay, WeChat, and other Chinese payment platforms to enable Chinese consumers to make payments in Singapore by scanning a QR code. JD established a smart logistics center in Thailand to deliver local orders within 24 hours. TikTok, a Chinese video-sharing social networking service, is widely popular in Southeast Asia, which is also helping cultural communication between China and ASEAN become more diversified.

Secretary General of ASEAN Dato Lim Jock Hoi predicts the digital economy in ASEAN to increase from 1.3 percent of GDP in 2015 to 8.5 percent by 2025. He noted China has a high level of expertise in developing digital infrastructure and implementing regulatory framework for the digital economy, making it a valuable partner for ASEAN in promoting development of the digital economy.

From a wide angle, the digital economy in China and ASEAN is developing vigorously and facing new opportunities. Both should continue to engage in practical cooperation and work to seize the potential in digital economy to propel economic and social development and improve quality of life.

Indonesia-based online ride-hailing platform Gojek provides custom bags and uniforms for drivers using the platform’s food delivery service, GoFood. (GOJEK)

Secretary General of ASEAN Dato Lim Jock Hoi predicts the digital economy in ASEAN to increase from 1.3 percent of GDP in 2015 to 8.5 percent by 2025.

BRIDGING THE DIGITAL DIVIDE

The digital divide in Southeast Asia may be exacerbated by COVID-19 and lead to further uneven development

By Yuan Yanan

When the COVID-19 pandemic forced people to stay home and away from crowds, the digital economy, or internet economy, started enjoying robust growth.

However, just as many people are hailing the arrival of the digital economy as a new engine of growth, some are worrying that the “digital divide” existing in Southeast Asia may be further deepened during the epidemic, resulting in more serious development imbalance.

Many people value the internet because it has potential to equalize the world, considering the essence of Information and Telecommunication Technologies (ICT) carries the possibility of realizing resource sharing and elimination of monopolies. However, uneven distribution in access and usage of ICT between countries, areas and even social classes has brought another form of inequality around the globe, including in Southeast Asia.

Digital Divide in Southeast Asia

The internet economy in Southeast Asia (SEA) is promising because the region boasts various drivers supporting the digital economy: a young population, strong economic growth, a rising number of internet users, and emerging online commerce. According to e-Conomy SEA 2019 released by Google, Temasek and Bain & Company, about 90 percent of an estimated 360 million internet users of six SEA countries (Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam) connect to the internet using mobile phones. The scale of the digital economy of the six countries is expected to reach US$300 billion by 2025.

Despite the fast growth, SEA countries face quite dramatic differences in internet penetration rate. According to statistics released by Statista, as of June 2019, Brunei ranked top among the ASEAN countries with an internet penetration rate of 94.9 percent, followed by Singapore, Thailand, and Malaysia. Indonesia, which has the largest population in the region, had an internet penetration rate of 53.2 percent, while the two countries at the bottom were Laos (35.4 percent) and Myanmar (33.1 percent).

Such a digital divide could widen the economic gap not only between countries but between groups. Disadvantaged groups lack access to ICT services such as e-commerce, online education, and real-time communications, which can hinder economic interests and social benefits. Such deprivation of digital resources is a new kind of poverty in the information era.

COVID-19 has catalyzed widening digital divide.

Micro, small, and medium-sized enterprises (MSMEs) have felt even more pressure during the outbreak. MSMEs account for a major part of ASEAN’s economy, contributing over 50 percent of the region’s GDP and employing 80 percent of the region’s labor. Since the pandemic, the real economy has been severely battered and many MSMEs relying on the sector have been struggling. According to research by Bain & Company, only 16 percent of MSMEs employed digital means for businesses before the outbreak, and 75 percent of proprietors believe that the digital economy would create development opportunities. The digital transformation means more market resources and lower financing costs, while the coronavirus has placed even more pressure on businesses to embrace digital technologies. Such transformation is even more challenging for micro-sized businesses run by individual households.

Worsened inequality can be found not only in economics but also in education. According to the United Nations Educational, Scientific and Cultural Organization (UNESCO), nearly 363 million children and teenagers have not been able to attend class since the outbreak of the coronavirus. In Southeast Asia, many schools were forced to close, leaving students with only online teaching. But a lot of poor students lack the necessary devices and bandwidth, and some do not even have a place to study. Inequality in education has been exacerbated by the digital divide, considering that wealthier students could have access to more educational resources including online teaching.

Closing the Divide

Inclusive growth requires equality in digital resources, which is why many ASEAN countries are upgrading their national ICT plans and setting corresponding regulation structures.

An important measure to bridge the digital divide is to provide training to MSMEs. The Asia Foundation carried out a survey involving 180 owners of Cambodian MSMEs and found that half of the respondents could not independently download apps or register an account for online banking services. To help more people benefit from digital technologies and grasp opportunities presented by the digital economy, ASEAN adopted GO Digital ASEAN, a program to train around 200,000 micro-sized business owners and young workers in rural areas of ASEAN countries.

China is also contributing to bridging the digital divide in ASEAN. Huawei, a Chinese telecommunications company, has been providing the ICT products and services to Myanmar telecommunications operators since 2003. “Over one in three Myanmar people connect with the support of Huawei, though some may not even know it,” said Zhang Liman, CEO of Huawei Technology (Yangon) Co., Ltd. “Huawei also worked with Yangon’s Thanlyin University of Science and Technology to launch HAINA (Huawei Authorized Information and Network Academy) with the aim to help young students learn ICT technologies.” Chinese finance companies such as China UnionPay Merchant Services Co., Ltd. and Ant Financial Services Group are also providing financial services for Southeast Asian MSMEs.

Lei Xiaohua, deputy director of the Institute of Southeast Asia Study of Guangxi Academy of Social Sciences, said that Chinese telecommunications companies have been helping ASEAN countries bridge the digital divide through various efforts such as facilitating construction of telecommunications infrastructure, upgrading networks, providing cost-efficient digital devices, and helping foster telecommunications talent.

Because this year has been dubbed the ASEAN-China Year of Digital Economy Cooperation, China and ASEAN will enhance joint efforts to share the benefits of the fast-developing digital economy. Alongside employing digital technologies to contain the COVID-19 pandemic and resume production, both sides will work together to support entrepreneurship and innovation, promote digital transformation of industries, and enhance cooperation in fields including 5G networking, the Internet of Things, artificial intelligence, and the industrial internet.

With mobile and online payments gaining popularity in Malaysia, Touch ‘n Go has emerged as a leading payment app. (XU Kangping)

Representatives from Chinese and Japanese companies attend a virtual signing ceremony in Kuala Lumpur, Malaysia, on June 17, 2020. Several agreements were inked to further cooperation. (ZHU WEI)

According to e-Conomy SEA 2019 released by Google, Temasek and Bain & Company, about 90 percent of an estimated 360 million internet users of six SEA countries (Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam) connect to the internet using mobile phones. The scale of the digital economy of the six countries is expected to reach US$300 billion by 2025.

CHINESE ECONOMY TO CONTINUE LEADING ASIA-PACIFIC GROWTH

Economist Shaun Roache outlines how China’s economy has recovered far beyond expectations

By Tian Yuan

On June 30, S&P Global Ratings released a report titled Credit Conditions Asia-Pacific: China First To Recover.

The recent introduction of 11 financial reform measures by the Office of Financial Stability and Development Committee under China’s State Council has allowed international rating agencies such as S&P Global Ratings and Fitch Ratings to enter the Chinese market and conduct more in-depth analysis of the Chinese economy.

To detail the prospects of Asia-Pacific economic growth, shine light on China’s role, and discuss other topics, China Report ASEAN conducted an exclusive interview with Shaun Roache, S&P’s Asia-Pacific senior chief economist and formerly chief economist of Singaporean sovereign wealth fund Temasek Holdings.

China Report ASEAN: The COVID-19 pandemic and the quantitative easing (QE) measures of the United States have caused great uncertainty for the global economy. Considering the situation, what are your expectations for Asia-Pacific growth?

Roache: Although the Asia-Pacific region has experienced the largest recession in more than four decades because of this pandemic, China and other major regional economies are expected to recover gradually for the rest of 2020. Since the outbreak of the epidemic, Asian countries have mostly promptly identified the challenges the disease poses for economic development and enacted policies in response. For example, Beijing’s quick response to the most recent cluster of confirmed cases in the city’s Xinfadi Agricultural Produce Wholesale Market demonstrated that China and other regional countries can successfully contain the virus quickly despite vast uncertainty, which is highly significant for the gradual reopening of Asia-Pacific economies. Therefore, S&P forecast that Asia-Pacific GDP will shrink by 1.3 percent in 2020 but grow by 6.9 percent in 2021. It also forecast China’s growth at 1.2 percent and 7.4 percent for 2020 and 2021, respectively.

Government stimulus will play a meaningful role in the first phase of Asia-Pacific economic recovery. S&P forecast China’s infrastructure investment to drive its economic growth in the latter half of 2020 to 5.5 percent. After that, when the effects of the stimulus measures gradually subside, “a handover from stimulus to consumption-driven demand will be needed to secure a self-sustaining recovery.” To achieve this goal, consumer confidence must be restored based on containment of the pandemic, more job openings, and optimistic prospects of vaccine research and development.

It is noteworthy that low-income workers in the hospitality and catering sectors are affected most by social distancing, which will worsen the income imbalance in the Asia-Pacific region. Construction of a social security network with unemployment assistance and retirement insurance during the next phase will be crucial to solving problems related to this imbalance and protecting the most vulnerable groups. S&P has noticed that the Two Sessions (annual meetings of China’s top legislature and its top political advisory body) 2020 clearly defined this as a priority of the work of the government. This evidences that the Chinese government is highly concerned with people’s livelihood, which is key to rapid economic recovery, but also crucial to long-term growth. Such policy is laying a solid foundation for the development and growth of the country’s middle class.

China Report ASEAN: How has the Asia-Pacific approach differed from the European and American approaches in combating the virus and reopening the economy?

Roache: Countries and industries in the Asia-Pacific region are at different stages of recovery in the post-pandemic period, but the region at large will remain the most dynamic region of the global economy. The region has maintained many unique advantages like stable economic fundamentals, formidable infrastructure, enlarged technical worker groups, and a large-scale sophisticated manufacturing supply chain that has emerged in just a few decades due to the above factors. These traditional advantages have not only brought to the Asia-Pacific region rapid economic growth, continuously-improved wages, and an ever-growing middle class, but also ensured that the region will continue to lead global growth.

It is even more impressive that China and other major Asian economies are gaining so much ground in high-tech fields such as semiconductors, communications infrastructure, e-commerce, and financial technology. Since the global financial crisis of 2008, economic globalization has stagnated, creating downward pressure on Asian economic growth. Even so, Asia will not lose titles of “world factory” and “innovation hub.”

China Report ASEAN: How do you think China’s timely reopening of its economy will influence the global supply chain and contribute to the restoration of the Asian economy?

Roache: China’s industry has recovered far beyond expectations. This February, some market players suspected that the novel coronavirus outbreak in China would lead to severe global supply chain disruptions because of China’s pivotal position in the global value chain. However, according to S&P estimates, less than three months after the peak of the pandemic, 95 percent of China’s large-scale companies have resumed production. It will take longer for the small and medium-sized companies to recover, but impressive progress has already been made. During this process, the Chinese government has regularly released information, especially data on new developments to provide ample clarity and comfort for companies resuming production. All these factors point to the strength of China’s supply chain and the resilience of its economy.

In addition to the recovery of the real economy, China is also leading the recovery of finance in the Asia-Pacific region. At present, low interest rates and government stimulus in the Asia-Pacific region have helped mitigate the impact of the pandemic to some extent, but weak demand has created pressure on credit conditions and led to rising risk of default, especially for issuers with weaker ratings. Credit conditions in the second half of 2020 will remain very difficult, according to Credit Conditions Asia-Pacific: China First To Recover. While signs of an economic recovery in China and some developed countries in Asia-Pacific have appeared, the report states, major emerging markets such as India are still struggling with large swaths of infection and a rising number of COVID-19 cases. Thanks mainly to government and regulatory actions, financing conditions have eased compared with late Q1 and early Q2.

S&P believes the Chinese government’s emphasis on “new infrastructure” in its latest development plans is also encouraging. This aligns with China’s vision of advancing structural reform for development driven by innovation instead of heavy industry. During this process, the public sector can play a key role in developing new industries by providing appropriate investment incentives. At the same time, we should keep in mind that the private sector is the main player in innovation-driven development. Therefore, maintaining a level playing field, especially through smooth financing channels for private sector companies, will be tremendously significant for China to continue the momentum of innovation-driven development.

Workers on the production line of an energy-saving materials company in Yiyuan County, Shandong Province, March 25, 2020. (ZHAO DONGSHAN)

Shaun Roache

REINFORCING THE WORLD FACTORY

Global manufacturing faces the same dilemma as Chinese manufacturing

By Zhang Lijuan

A few countries seized the opportunity of the coronavirus outbreak to upgrade their protectionist agendas by decoupling and disrupting the global industrial and supply chains. For example, Japan has implemented a plan to “recall” some Japanese companies, while U.S. National Economic Council Director Larry Kudlow encouraged U.S. businesses to return to the U.S., arousing speculation that the global industrial chain was severing connections with China.

Will the changes accelerated by the pandemic decouple the global industrial chain from China? Will China’s “world factory” status be shaken? What should China do to consolidate and upgrade its position and role in the global value chain?

Backlash Against Globalization

In recent years, international competition in the manufacturing industry has been undergoing profound changes. Under the shadow of the novel coronavirus outbreak, the situation is becoming more complex and posing new challenges for China’s manufacturing industry.

Zhou Mi, a researcher with the Chinese Academy of International Trade and Economic Cooperation under the Ministry of Commerce, believes that current circumstances have brought China’s manufacturing industry three challenges: First, overall demand has weakened significantly with the general slowdown of global economic activity. Demand for both final consumption goods and intermediate goods may not recover to pre-pandemic levels for some time. Second, the supply and demand structure of the market has changed dramatically. The pandemic has accelerated changes of economic and industrial patterns in every country while restructuring the global supply chain, which had made it necessary for Chinese companies to search for new upstream and downstream economic and trade partners. Third, the pandemic has changed the modalities for the global allocation of factors of production. Cross-border travel restrictions and other measures to contain the virus have accelerated technological progress and innovation in a way that has profoundly impacted business development.

The pandemic aggravated numerous challenges for China’s manufacturing industry including difficulties in production resumption, supply chain fragmentation, sluggish market demand, and derivatives blights such as tight cash flow, pressure of wage payment and loan repayment. The added value of China’s manufacturing industry in the first quarter of this year declined 10.2 percent year on year, evidence of the short-term impact of the pandemic.

“The most important player in the global manufacturing industry, Chinese manufacturing is facing interruptions in the supply chain, export stagnation and other major difficulties after the global spread of the virus,” commented Wu Shiqian, a graduate tutor at Shanghai University’s School of Journalism and Communication, “But the recall of the manufacturing industry in certain countries is backlash against globalization and inconsistent with laws of development in the global economic landscape. It’s only natural that labor intensive industries with low added value operate in different places.”

According to Liu Xiaoguang, a researcher with the National Academy of Development and Strategy and assistant director of the Economic Research Institute of Renmin University of China, China’s advantages in developing manufacturing are obvious. It is not feasible for individual countries to recall their manufacturing capabilities while coping with the impact of the pandemic. At the end of the day, capital is profit-driven. China is not only a world factory, but also a global market and an emerging innovation market. As the world’s largest industrial country, China has a complete production system and a complete industrial chain with an increasingly mature industrial system based on innovative research and development. China has a massive domestic market that is growing and upgrading constantly. The country has strong demand for both final goods and intermediate goods—strong and sustainable demand. Such factors are huge advantages for China as it develops the manufacturing industry. At the same time, China is constantly promoting market-based allocation of factors of production to further boost the vitality of the market economy. So, it is not in the long-term business interests of individual countries to bring back their manufacturing operations.

Liu argues that in the short term, multinational corporations lack the means or strength to recall their business from abroad while dealing with the severe impact of the pandemic. Among the world’s major economies, China has taken the lead in getting the pandemic under control with timely and effective containment measures before returning to full production. In contrast, the virus has spread at a faster pace in other parts of the world, spinning out of control in many European and American countries. Under such circumstances, it’s wiser for multinational corporations to continue operating in China instead of returning to their native countries. Meanwhile, the pandemic has dealt a big blow to the manufacturing industry around the world, forcing global manufacturing to face the same dilemma as Chinese manufacturing. Multinational corporations are not in the position to consider closing businesses in China and investing in new businesses in their native countries while dealing with broken global supply chains, inadequate market demand, and tight cash flow. Such a move would only put them under tremendous pressure of capital and debt repayment, which would unlikely be eased by the high debt-to-GDP ratio in their native countries. With an incomplete domestic industrial system and drastically shrinking market demand in their native countries, returning corporations would likely face major losses.

On May 29, the American Chamber of Commerce in China released the results of a flash survey to measure the impact of the COVID-19 outbreak on its member companies, which showed that 38 percent of respondents would maintain previously planned investments or increase planned investments, which was consistent with the results of the previous month. Furthermore, 24 percent of respondents indicated that they were increasingly in need of support from their teams in China for global operations, up 10 percent from the previous month.

“This indicates that both patience and confidence of foreign investment in China are stabilizing alongside the recovery,” said Liu.

‘World Factory’ to Be Reinforced

The complicated changes and adjustments in the global industrial chain caused by the pandemic will impact China’s status as a global manufacturing center and the competitiveness and influence of Chinese manufacturing in the global market. But will China’s “world factory” status be shaken?

“China’s manufacturing industry is now facing two-pronged pressure from both home and abroad,” said Wu Shiqian, “But in the short term, China’s manufacturing industry is a global leader in industrial chain integrity. For the long term, China’s manufacturing industry will be adjusted and optimized for high added value. The rapid development of the industrial internet, artificial intelligence, and other technologies will help China’s manufacturing industry continue to lead the world. In 2010, China’s manufacturing output surpassed the United States for the first time. It has remained in first place ever since. Many countries in the world rely heavily on Chinese manufacturing. China’s ‘world factory’ status will not be easily shaken.”

Liu Xiaoguang agreed that the pandemic has caused changes and adjustments in the global industrial chain. For the short term, the worsening of the pandemic has hit industrial systems and supply chains hard in some countries. Many countries have had to lock down for extended periods. Risk of the global industrial chain becoming paralyzed persists while demand for trade has contracted markedly. In the medium term, the different levels of impact on different economies and rhythm of recovery from the pandemic will be highlighted by regional hot spots during recovery of the global industrial chain. For the long term, the severe impact of the pandemic on global economic order and governance and the intensification of domestic social issues in different countries could exacerbate trade protectionism and populism, creating severe challenges for the globalization process and the global industrial chain.

“China’s ‘world factory’ status will not be shaken in the short to medium term,” said Liu. “Quite the contrary, it will become more consolidated. Look around the world and you will see that China is among the most active major economies. The pandemic has been effectively contained in China aside from a few imported cases and isolated cases here and there. China’s macroeconomic policy space is relatively adequate as reflected in relatively low debt-to-GDP ratio and relatively high policy interest rates and reserve requirement ratios. China’s financial markets have been relatively stable and shown remarkable success in preventing and defusing major financial risks over the past few years. And the sharp drop in international crude oil prices has helped China, a net importer of oil, reduce manufacturing costs when resuming production.”

Zhou Mi pointed to the decisive role of the market in the allocation of resources determining the investment behavior of companies. Over the years, as China’s local manufacturing industry has developed rapidly, many global manufacturers have settled in China— not simply for the cost of labor, but also for the benefits of the stable investment environment, wider openness, and access to a market with huge growth potential. For many years, neither appreciation of the Chinese currency nor a global financial crisis has changed the international competitiveness of Chinese manufacturing. So, the situation is also unlikely to change with this pandemic. China has taken the lead in effectively containing the virus and returning to production with a strong competitive edge.

‘New Infrastructure’ to Boost Upgrading

In its 40 years of reform and opening-up, China has built an industrial system that is both comprehensive and independent. It is the only country in the world to have activity in every section of the United Nations’ International Standard Industrial Classification of All Economic Activities (ISIC). China’s manufacturing industry, at the heart of the industrial system, already possesses a global advantage in scale. Against the backdrop of changes and adjustments to the global industrial chain caused by the pandemic, how should Chinese manufacturing consolidate and upgrade its position and role in the global value chain?

“Chinese manufacturing sector has advantages such as an integrated industrial chain, a large domestic market, early development of the industrial internet, and a high degree of automation,” said Wu Shiqian, “Chinese manufacturing cannot do without the help of ‘New Infrastructure’ (an economic development concept based on new high-tech infrastructure such as 5G, big data, and artificial intelligence as opposed to traditional infrastructure-based development) to address existing challenges. Specifically, Chinese manufacturing must leverage big data, the industrial internet, and artificial intelligence to transform and upgrade to digital and smart technologies by focusing on core technologies, reducing dependence on imports for some links, and further improving supply chain integrity with higher quality, more energy efficiency, and higher added value.”

Zhou Mi credited the pandemic with causing significant changes in the global market in terms of both supply and demand, which have been both uncertain and imbalanced. To adapt to these changes, Chinese companies should cooperate with their trading and investment partners with greater openness instead of seeking benefits at the expense of others. At the same time, they should actively expand global sales networks, open to multiple markets, and improve their flexible adaptability to changes in demand. Considering the positive effects of the pandemic on the digital economy, they should actively accumulate e-commerce experience, accelerate industrial upgrading, and seize opportunities for future competition.

“Given the severe impact of the pandemic on the global industrial chain, priority should be placed on expanding domestic demand,” said Liu Xiaoguang, “China is now at the stage of routine pandemic containment. The impact of the pandemic on the supply side has been essentially fixed, but its impact on aggregate demand is still strong and will continue for some time.”

Statistics show that the decline of China’s three major demands (consumption, investment and export) outpaced the fall of the economy in the first quarter of this year. Since March, although Chinese manufacturers have gradually returned to normal production, the three major demands still have declined by about 10 percent.

Liu considers it necessary to strengthen counter-cyclical regulation in macro policies and implement a strategy of expanding domestic demand. He suggested that more robust macro policies, especially more aggressive fiscal policies, would likely be effective in curbing the impact of the pandemic and stabilizing the economy.

“Export companies need to maintain sufficient resilience,” Liu said. “During this period, they should weather the storm by shifting focus from overseas markets to the domestic market. In the second and third quarters of this year as we begin to recover from the pandemic, market demand for both finished goods and intermediate goods will have recovered significantly from the first quarter. At the same time, preferential fiscal and tax policies such as tax and fee cuts, lower oil prices, wage subsidies and direct loans to small and medium enterprises will help many companies recover.”

A technician on the production line of a pharmaceutical equipment company in Yichun, Jiangxi Province, February 24, 2020. (ZHOU LIANG)

On May 29, the American Chamber of Commerce in China released the results of a flash survey to measure the impact of the COVID-19 outbreak on its member companies, which showed that 38 percent of respondents would maintain previously planned investments or increase planned investments, which was consistent with the results of the previous month. Furthermore, 24 percent of respondents indicated that they were increasingly in need of support from their teams in China for global operations, up 10 percent from the previous month.

A China-Europe Railway Express cargo train departs Wuhan for Duisburg, Germany, on March 28, 2020. It was the first train from Wuhan to Europe since the novel coronavirus outbreak. (XIAO YIJIU)

Finished concrete pump trucks in the Automobile Industry New Town in Qingdao, Shandong Province, ready for overseas markets on April 7, 2020. (LIANG XIAOPENG)

PERFORMING ON TWO FRONTS

Chinese SOEs are making big moves to resume production in ASEAN after pandemic

On the morning of July 3, 2020, the groundbreaking ceremony for the Vientiane station of the China-Laos Railway (CLR) was held in the Lao capital in a warm atmosphere despite light drizzle. More than 200 construction staff and 20 pieces of heavy machinery marked with the logo of China Railway Construction Group (CRCG) were lined up at the event site. Xiao Qianwen, general manager of the Laos-China Railway Co., Ltd., a Vientiane-based joint venture in charge of the railway’s construction and operation, gave the command to commence construction of the widely-anticipated station building.

The CLR runs from Kunming, China, all the way to the capital of Laos, with 422.4 kilometers within Laos’ borders. The largest among 20 new stations along the rail line, the Vientiane station will be able to accommodate 2,500 passengers in a construction area of 14,543 square meters. Themed “China-Laos Friendship in the City of Sandalwood”, the people-centric and environmentally friendly design employs simple, integrated and modern styles and cultural and national elements from both countries.

In recent months, construction of the CRL has forged ahead amid the COVID-19 pandemic and completed numerous key projects including four tunnels, the first leg of track construction, the first communication tower, and main beam connection for a super bridge.

Using Chinese technical standards and equipment, the CLR is Laos’ first standard-gauge railway and China’s first overseas railway project primarily funded and built by Chinese companies and connected to China’s railway network since the Belt and Road Initiative was proposed. When completed at the end of 2021 as scheduled, the rail project will help Laos achieve its ambition of transforming from a landlocked to a land-linked country and promote national economic development.

In the meanwhile, construction of the Jakarta-Bandung high-speed railway in Indonesia also is moving full speed ahead. At the construction site of Tunnel No. 10, 30 kilometers west of Bandung, trucks growled, machinery roared, and workers grimaced while excavating the tunnel face and binding steel bars.

Heavy rainfall during this year’s wet season coupled with the raging pandemic has led to an increased workload for the rail project. To cope with the pressure, the project management department arranged a special task force. According to Xiao Songxin, head of the project contractors’ consortium, 2020 is a critical year for construction of roads, bridges, and tunnels. So far, 96 percent of the land needed for the high-speed rail has been secured, 50 percent of roadbed and tunnel projects have finished, and 30 percent of bridges have been completed. The Jakarta-Bandung high-speed railway project is now advancing smoothly while epidemic prevention and control work continues. More than 10,000 staff are working at 229 project sites along the line.

To ensure continuing progress of crucial projects, a series of emergency response and personnel management measures were implemented after the COVID-19 outbreak in Indonesia including placement of a public health officer at each project site, regular temperature checks, social distancing, and sufficient reserves of personal protective equipment and daily supplies. Under normalized epidemic prevention and control, contractors of the high-speed rail have made every effort to follow safety and health protection guidelines of both China and Indonesia, help workers return to work, and accelerate import of materials and equipment to facilitate steady progress during the upcoming dry season, the optimal period to perform construction work.

From energy facilities to transportation infrastructure, Chinese state-owned construction enterprises have continued working during the pandemic. Their joint endeavors have helped ensure steady advancement and satisfactory performance to meet the contract terms of their major projects in Southeast Asia.

On April 13, Indonesia’s Jatigede dam built by Power Construction Corporation of China (POWERCHINA) succeeded in impounding water to an elevation of 260 meters, a crucial step towards full operation that will benefit 4.8 million local people. The Chico River Pump Irrigation Project constructed by China CAMC Engineering Co., Ltd. in the Philippines resumed production in early May and fulfilled 47 percent of the total contract value by the end of the month, two percentage points ahead of schedule. On June 14, Sinohydro Bureau 10 Co., Ltd. completed drilling of the surge shaft for the Nam Ngum 3 hydropower station project in Laos 18 days ahead of schedule.

As the epidemic was gradually subsiding in Southeast Asian countries, Chinese companies began to deliver more and more encouraging results in project construction.

Anti-epidemic Endeavors

“From the day after Chinese New Year to now, our overseas staff have maintained their posts on three fronts: supporting domestic epidemic containment, anti-epidemic campaign in host countries, and resumption of production,” declared Peng Dapeng, deputy head of Overseas Business Division of China Communications Construction Company (CCCC).

As early as January 28, the CCCC established an overseas joint prevention and control mechanism to facilitate communication through regular online meetings and daily reports. The mechanism was later improved and expanded from regional-level coordination to a national-level system. A special emergency response plan was also developed to provide guidance for overseas project sites and offices on protecting employees’ safety and health. During the early stages of the epidemic outbreak, about 40 percent of the company’s 1,000-plus overseas projects were completely or partially disrupted. Now, many have resumed construction after implementing multiple containment measures to keep staff safe.

In Cambodia, construction of the Phnom Penh-Sihanoukville expressway has been proceeding smoothly. An important Belt and Road project funded and constructed by China Road and Bridge Corporation (CRBC), the country’s first expressway will significantly cut travel time from its capital to the southwestern port city of Sihanoukville and help drive economic development. “Continuing construction while containing the epidemic has been the top priority on every daily agenda,” said Xu Song, one of 280 Chinese and Cambodian employees of the project’s fourth management department. Specific epidemic prevention and control measures have been employed at the project site including closed-off management, personnel movement control, temperature checks twice a day, disinfection of office and living areas twice a day, wearing of masks in public space, and individual dining.

In addition to safeguarding employees’ safety and health, overseas branches of Chinese state-owned enterprises (SOEs) have also effectively fulfilled corporate social responsibility. To help people in host countries cope with the epidemic, they provided locals around the project sites with handbooks in the local language on how COVID-19 spreads and how to protect themselves against the dangerous disease.

On March 2, the Bengkulu Coal-fired Power Plant, built and run by POWERCHINA, received its first electricity bill payment from Indonesian state-owned power utility Perusahaan Listrik Negara. The transfer signified that all procedures for charging electricity rates were completed and that the plant began generating revenue. The first unit of the plant achieved grid-connected power generation last November.

“We strive to produce satisfactory results during this tough test,” stressed Sheng Yuming, chairman of POWERCHINA Resources, the overseas investment arm of the energy giant. He noted that strict movement control measures have been introduced and a psychological intervention mechanism established to provide counseling service for company personnel.

Stepping up Production

As important links of global industrial supply chains, Chinese SOEs have invested heavily in rebooting construction work on overseas projects to keep them on schedule.

With movement controls relaxed in Laos, State Grid Corporation of China was permitted to resume the construction of 500-kilovolt and 230-kilovolt power transmission lines in Vientiane in early May. Various work at the construction site such as steel bar binding, formwork installation, concrete casting and maintenance, and removal of formwork are now progressing steadily. “Everything has been going smoothly since work restarted,” reported site manager Ding Zheng. “We have to speed up to get back on schedule.”

Considered a future monument to China-Philippines friendship, work on two bridges over the Pasig River built by the CRBC also resumed in early May. “Before returning to work, local employees were required to self-quarantine at home for 14 days and provide proof of good health,” said project manager Yuan Xiaocong. “They were then transported to construction sites by chartered bus and put in another 14-day quarantine until they pass a COVID-19 test.” Alongside closed-off management and regular disinfection at the project sites, workers were also assigned staggered shifts and forbidden from gathering.

The Chico River Pump Irrigation Project, another Chinese-contracted infrastructure project in the Philippines, also reopened in early May after three months of suspension. The project has so far resumed 90 percent capacity, and 80 percent of construction staff have returned including nearly 400 Filipino employees, none of whom have contracted the disease. During a video conference on June 23, Chinese Ambassador to the Philippines Huang Xilian reinforced expectations for the project from three aspects: sound management to ensure personnel safety, equal treatment of Chinese and local employees in terms of epidemic prevention and control, and an optimized project plan to facilitate early completion.

By the end of May, nearly 90 percent of the pump house structure was constructed, 85 percent of the 30-kilometer-long 69-kilovolt transmission line was erected, and the Tunnel No. 1 was finished ahead of schedule. The pump house is expected to be roofed by the end of September and the entire project completed by the end of 2021. When the pump station begins operation, the whole irrigation system will be able to supply enough water to irrigate 8,700 hectares of farmland in Cagayan and Kalinga provinces, which will help improve farming and increase crop yields, benefiting 4,350 rural households. The project will also create ample job opportunities for local communities.

Confronted by the daunting task of continuing construction work on overseas projects amid the COVID-19 pandemic, Chinese SOEs have demonstrated perseverance and strong social responsibility in host countries while making outstanding contributions to the Belt and Road Initiative.

Construction site of Super Bridge No. 2 of the Jakarta-Bandung high-speed railway in Jakarta, Indonesia, May 11, 2020. (DU YU)

The Yuanjiang Railway Bridge of the China-Laos Railway under construction, July 1, 2020. (ZHU XIAOCHEN)

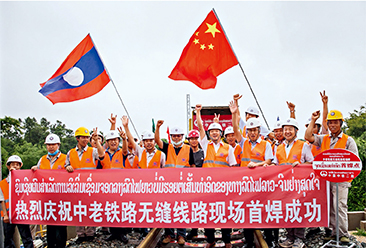

Workers of China Railway No. 2 Engineering Group celebrate the first on-site welding of seamless tracks of the China-Laos Railway in Vientiane, Laos, on June 18, 2020.(Kaikeo Saiyasane)

Construction site of Super Bridge No. 2 of the Jakarta-Bandung high-speed railway in Jakarta, Indonesia, May 11, 2020. (DU YU)

A top official from the Cambodian Ministry of Public Works and Transport (first left) visits the central laboratory of the Phnom Penh-Sihanoukville expressway in Kampong Speu, Cambodia, on June 12, 2020. (XINHUA)

EXPORTERS TURN TO DOMESTIC MARKET

Foreign trade companies’ exploration of transformation and development in the post-pandemic period

By Pan Yingqiu

“Recently, I bought online a lot of high-quality and reasonably priced goods including clothing, household goods, and bedding, which were originally export-oriented products but are now available in domestic market,” said Chen Ni, a Beijing resident, while demonstrating shopping apps such as Taobao, JD and Pinduoduo on her cell phone.

Due to the COVID-19 pandemic, foreign trade companies’ domestic sales are increasing. During this year’s June 18 online shopping carnival, many foreign trade companies suffering losses of business in overseas markets demonstrated how they have seized e-commerce platforms and livestreaming to promote domestic sales.

Will this be an effective way for foreign trade companies to transform and develop in the post-pandemic period?

Exploring Domestic Market

“Foreign trade companies face a dire situation these days,” said Tang Yihu, manager of an agricultural machinery company in eastern China’s Shandong Province. “Most of our clients are overseas. Due to the novel coronavirus outbreak, many foreign ports have been locked down. When our goods arrive at the few ports that are still open, it takes a long time for us to communicate and coordinate with our clients to receive them. Our only hope for survival seems to be the domestic market. However, a lack of sales channels and brand reputation in the domestic market leaves a ton of work.”

Many foreign trade companies face the same difficult situation. To help solve the serious problem of overstock of goods caused by cancellation or postponement of overseas orders, the department of commerce of the Shandong provincial government organized sales of export-oriented civilian consumer goods through either local department stores or on livestreaming platforms. The department also arranged for foreign trade companies to sell their products on Alibaba’s e-commerce platform 1688.com or in Hema Fresh’s O2O stores.

“Food, clothing, crafts, household goods and other export-oriented consumer products have great potentials in the domestic market,” said Xu Bingbo, an official with the provincial commerce department, “Livestreaming on e-commerce platforms works to sell export-oriented industrial products as well as services.”

Statistics released by Jingxi, a JD social e-commerce platform, showed that in the two months after the launch of an assistance program for foreign trade companies to sell their products in the domestic market in mid-April, more than 10,000 companies registered with the platform. From June 1 to 17, the volume of orders for products from foreign trade companies through the platform increased more than 100 percent over the same period last month.

Jingxi’s operations manager Feng Yan explained that keyword phrases people search for such as “electronic thermometer,” “children’s mask,” and “ear thermometer” revealed an emerging market for baby thermo wristwatches. The custom-made product designed by a foreign trade company has been well received by consumers.

Li Danghui, deputy director-general of the department of consumption promotion at the Ministry of Commerce, commented that sales of export-oriented products in the domestic market will further diversify supply in the domestic market to meet the increasingly refined needs of consumers and expedite a consumption upgrade. At the same time, domestic sales of export goods will leverage the country’s advantages in market size and potential for domestic demand.

Making It Happen

Can foreign trade companies with export-oriented goods and services looking to the domestic market simply consider the different selling block? The shift is not so simple because of differing standards for goods and services in domestic and overseas markets. Foreign-oriented goods are produced according to demands and standards of the intended overseas market and do not necessarily conform to domestic consumption preferences.

For export-oriented goods to be sold in the domestic market, they must meet the needs of Chinese consumers and leverage appropriate brand promotion and distribution channels. Many export goods face competing products in the domestic market and competition is just as fierce as in foreign markets. Relevant companies must also tackle problems such as unknown brands, new markets, and a lack of experience and resources. They must make tough decisions on whether the shift is a temporary damage control or a long-term strategic transformation.

To meet the pressing needs of foreign trade companies, the State Council issued a guideline on June 22 to help exporters sell products domestically and help Chinese businesses in the foreign trade sector overcome difficulties to keep foreign trade stable.

Access to the domestic market should be accelerated for exporters, according to the guideline. Enterprises are encouraged to produce products on one production line following the same standards and the same quality requirements for both foreign and domestic markets. Article I of the guideline is highly significant to those dealing with an overstock of goods from the pandemic. It stipulated that the government would lead simplification of certification procedures to expedite foreign trade companies’ access to the domestic market. Article II encouraged foreign trade companies to make products that meet both domestic and foreign standards as the government builds informational platforms to help them transform production.